The ₹30,000+ Crore SME IPO Journey Every Business Owner Should Know

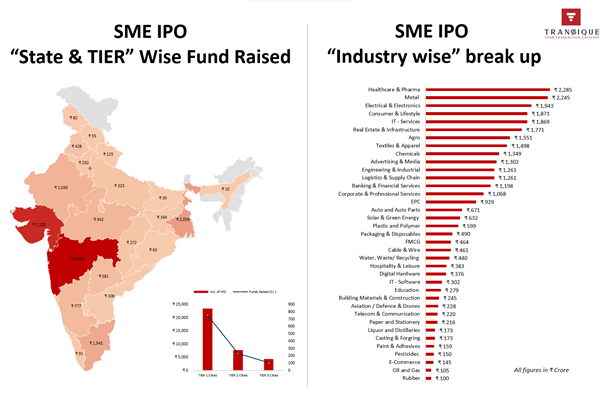

Do you know that over 1,270 Indian SMEs across 30+ industries and 120+ cities have raised more than ₹30,000 crore through SME IPOs?

What’s striking is the sharp momentum: About 78% of this equity capital has been raised in the last 4.5 years, demonstrating how SME IPOs have become the preferred growth engine for SMEs.

“The SME IPO success story is not restricted to new-age entrepreneurs. Whether you are in manufacturing, services, or even a traditional sector, the market has shown that investors are ready to back credible businesses.”

👉 Assess your SME IPO Readiness Scorecard

Key Insights for SME Owners

The SME IPO market has moved beyond being a niche experiment to becoming a powerful, credible, and preferred source of equity capital for SMEs, giving Indian businesses a healthy alternative to bank debt.

- ✅ ₹30,000+ crore raised by Indian SMEs

- ✅ 1,270+ companies listed from 30+ industries & 120+ cities

- ✅ 78% of funds (₹23,696 crore) raised in the recent 4.5 years

- ✅ ₹6,770+ crore raised in 2025 (till Aug), with 2025 annualised funding crossing ₹10,000 crore, showing strong momentum

- ✅ SMEs succeeding by disciplined approach, balancing growth with investor trust

- ✅ Winning SMEs focusing on growth and profitability, robust financial controls, compliance and governance discipline, fair valuation, transparent storytelling, and right timing

Capital is the lifeline of any business – especially for SMEs.

For years, Indian SMEs have relied mostly on bank loans to fund their growth. While useful, bank debt comes with its own challenges:- Fixed interest costs

- Need for collateral (like land, building, or machinery)

- Steady business cash flow required for repayments

- Promoters have to invest their own equity too for bank financing

On the other hand, raising equity capital (from venture capitalists, private equity funds, or via IPOs) has traditionally been available only to large, fast-growing, tech companies or mature businesses with strong corporate governance.

To bridge this gap for traditional Indian SMEs—especially those in manufacturing, services, or distribution—a new path was opened up in 2012: the SME IPO.

Since then, more and more SMEs have used this route to raise growth capital without taking on debt. As of August 2025, Indian SMEs have collectively raised over ₹30,000 crore through SME IPOs. Moreover, the fundraising momentum has significantly accelerated since 2021, reaching new heights.

This remarkable journey shows how SME IPOs have moved from a niche option to a mainstream growth driver, opening new possibilities not just for big corporates but also as a real viable option for growing SMEs, reflecting growing maturity, stronger investor trust, and wider access to capital for deserving businesses.

Looking Ahead

Indian SMEs are turning towards IPOs as a strategic tool for sustainable expansion, business transformation, and unlocking hidden value for SME owners and stakeholders while raising long-term capital, building lasting market credibility, and attracting long-term investors.

At Transique Corporate Advisors, we have successfully guided SMEs across industries through their IPO journey, including Pre-IPO, IPO and Post-IPO phases, helping them raise equity capital, unlock their hidden business value, build credibility, while staying in control of their businesses.

👉 If you’re considering raising funds and want to explore whether an SME IPO is the best fit for your business, our team of SME IPO specialists can guide you through every step—from eligibility assessment to successful listing.

👉 Assess your SME IPO Readiness Scorecard

👉 Book Your 30-Minute Complimentary Consultation

India’s SME IPO story is no longer a niche experiment—it’s a mainstream growth engine. With the right strategy and guidance, your business could be next.