The 2025 SME IPO landscape is being shaped by maturity, discipline, and stronger fundamentals. Investor expectations are sharper, regulations stricter, and only well-prepared companies are finding success. This marks the beginning of a healthier and more sustainable phase for India’s SME capital markets.

At Transique Corporate Advisors, we see this as a golden opportunity for well-governed SMEs with good business models to raise long-term capital while building lasting market credibility.

How SME IPOs Have Performed Over the Years

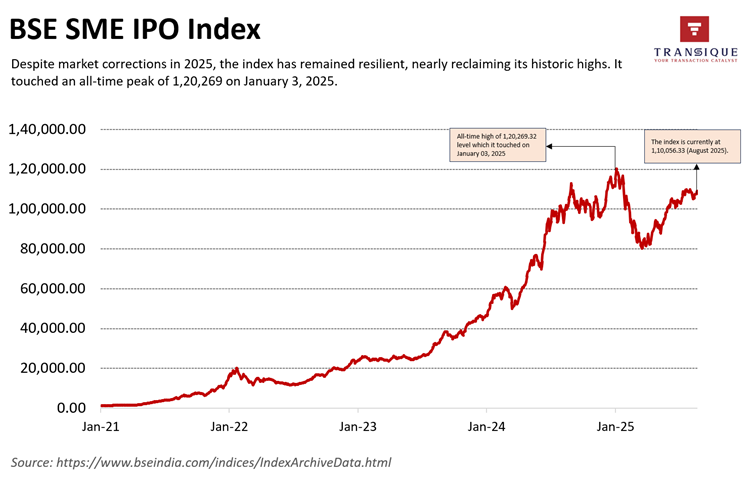

The long-term performance of SME IPO indices reflects rising investor interest and strong wealth-creation potential. The BSE SME IPO Index clearly highlights three distinct phases

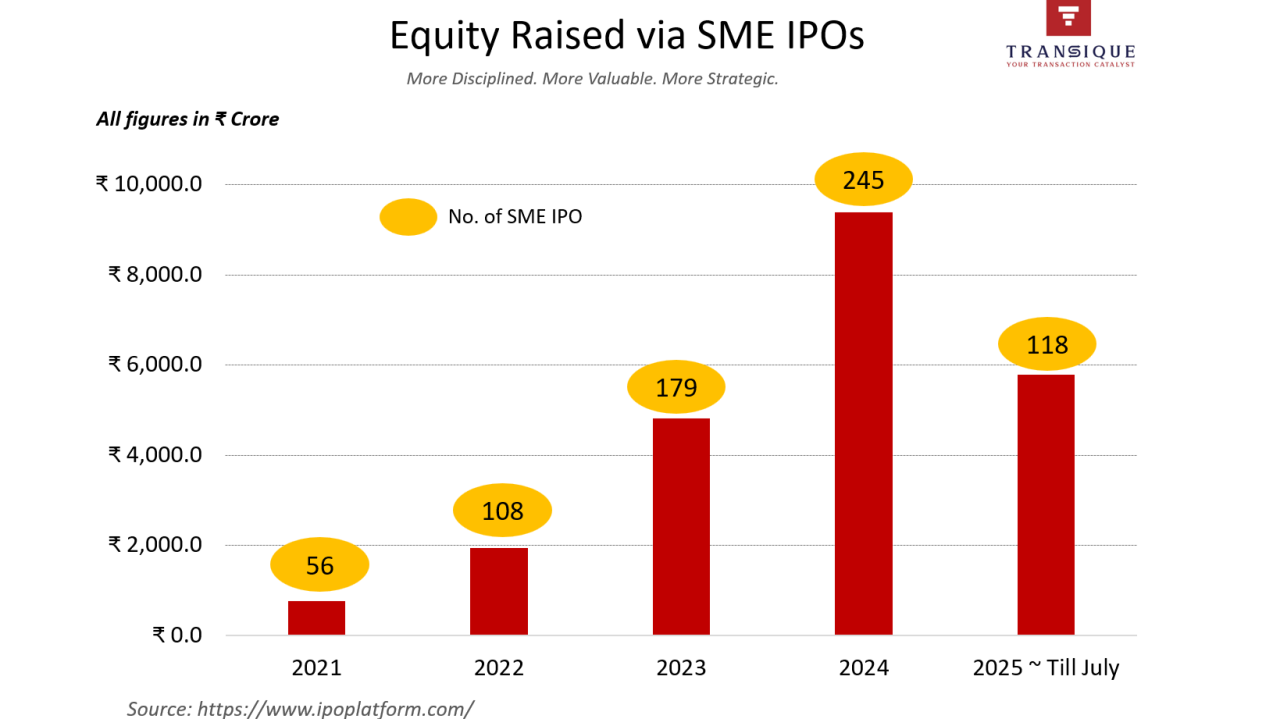

Fundraising through SME IPOs has expanded by more than 12 times over the last four years, rising from ₹796 crore in 2021 to ₹9,394 crore in 2024.

- 2021–22: A steady climb as early participation laid the foundation for growth.

- 2023–24: A breakout rally, driven by record IPO activity, strong listing gains, and rising investor appetite.

- 2025 (H1): A period of volatility and adjustment due to tighter regulations and selective funding. Despite this, the index is attempting to regain near all-time highs in 2025, reflecting the market’s resilience.

A major reason for this shift is tighter SEBI regulations. Since 2025, stricter SEBI norms mean SMEs with:

- Stronger financial performance (EBITDA more than 1 crore in 2/3 preceding financial years)

- Restrictions on Offer for Sale (OFS) up to 20% of the Issue Size

- Positive Free Cash Flow Equity (FCFE) requirements for NSE Emerge IPO

- General Corporate Purpose (GCP) amount restricted to 15% of the Issue size or Rs. 10 Crore (whichever is lower)

- IPO proceeds for repayment of Promoter loans – Not Permitted

- A time gap of 1 year is required after the change of Promoters for DRHP filing

- Time gap of 1 full financial year is needed after conversion from proprietorship/ partnership / LLP before DRHP filing.

- Good governance practices with limited Related Party Transactions at Arm’s Length Price

- Emphasis on Legal and Regulatory Compliance, Litigations, and Risk Factors

- Monitoring Agency requirement above 50 crore Issue Size

- Strengthening of Merchant Banker’s Due Diligence and DRHP Disclosures

The market lot in the Retail category has also been doubled to restrict retail participation in SME IPOs. All these changes have been made to filter out speculative companies and strengthen investor confidence.

Fundraising Remains Strong as Larger SMEs Lead

The resilience of SME IPO indices, even in volatile conditions, reflects a clear shift in market behaviour.

- 2024: SME IPOs touched a record 245 listings, raising ₹9,394 Crore

- 2025 (till July): Activity has moderated to 118 listings, compared with 141 in the same period last year.

At first glance, this slowdown may look concerning. But in reality, it highlights a healthier transition. Activity in 2025 is still far above pre-2023 levels, showing that the market is no longer chasing numbers; it is focusing on quality over quantity.

However, the moderation in IPO activity has not reduced fundraising momentum further; the value of IPO funds raised in 2025 has remained at 5,457 crores in 2025 from INR 4,887 crores in 2024 (till July). The average value of IPO has also increased to 46 crores in 2025 from 38 crores in 2024.

This means that the typical deal size is getting larger, highlighting a shift toward stronger and more credible companies entering the market.

2025: A RESET Phase for More Mature SME IPO Ecosystem

What we are seeing in 2025 is not a slowdown, but a healthy reset. India’s SME IPO market is becoming more selective, resilient, and rewarding for well-prepared companies. This trend reflects a more mature SME IPO ecosystem.

With rising investor expectations and stricter regulations, quality has become the defining factor. SMEs with strong cash flows and profitability, good governance, and clear long-term growth strategies are successfully attracting capital and investor trust. The increase in average IPO sizes, along with steady fundraising despite fewer listings, highlights this shift.

For SMEs, IPOs are no longer just about getting listed; they are about signalling credibility, readiness to scale, and delivering sustainable performance. If 2024 was about momentum, 2025 is about maturity, offering well-prepared businesses a stronger foundation for future growth.

The message is clear: while the number of IPOs has slowed, the average IPO size is rising. Larger, well-established SMEs with strong balance sheets, stable cash flows, and long-term strategies are now driving fundraising.

This is not a slowdown; it is a strategic reshaping of the SME IPO landscape, where scale-ready companies are commanding investor trust and raising meaningful capital.

The outcome: fewer IPOs, but stronger ones. For investors, SME IPOs are emerging as a more reliable and value-driven asset class.

Based on our analysis at Transique Corporate Advisors, SEBI’s recent measures are reshaping the SME IPO market. Stricter eligibility thresholds introduced in March 2025 and enhanced disclosure and financial benchmarks from December 18, 2024, are ensuring that only well-governed, financially robust SMEs qualify.

These changes are driving a more disciplined, transparent, and mature IPO ecosystem, where investor confidence is increasingly anchored in quality and credibility.

At Transique Corporate Advisors, we handhold profitable businesses to navigate their IPO journey with the right strategy and discipline, leading to the unlocking of their hidden business value.